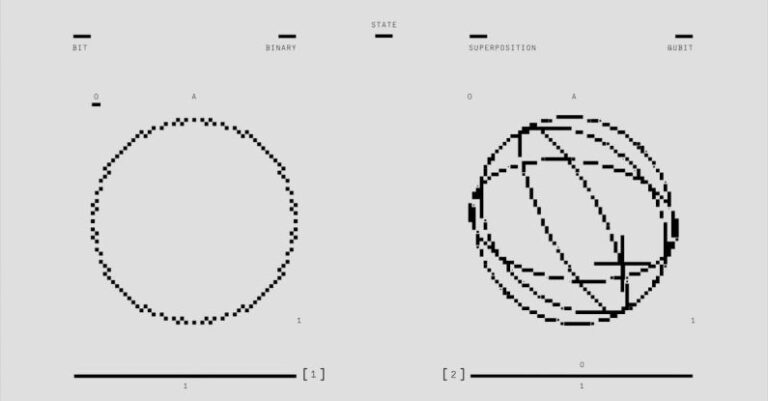

In the ever-evolving landscape of finance, blockchain technology has emerged as a revolutionary force, transforming the way transactions are conducted, recorded, and verified. With its decentralized and transparent nature, blockchain has disrupted traditional financial systems, offering increased security, efficiency, and accessibility. Let’s delve into the pivotal role that blockchain plays in modern finance.

**The Foundation of Trust**

At the core of blockchain technology lies its ability to establish trust among transacting parties without the need for intermediaries. By creating a tamper-proof, distributed ledger that records every transaction in a transparent and immutable manner, blockchain eliminates the risk of fraud and manipulation. This foundational aspect of blockchain instills confidence in users, fostering a more secure financial ecosystem.

**Enhanced Security Measures**

One of the most significant advantages of blockchain in modern finance is its unparalleled security features. The decentralized nature of blockchain means that data is stored across a network of computers, making it extremely difficult for hackers to compromise the system. Each transaction is securely encrypted and linked to the previous transaction, forming a chain of blocks that are virtually impossible to alter. This level of security offers peace of mind to both individuals and institutions engaging in financial transactions.

**Efficiency and Speed**

Blockchain technology has streamlined the process of conducting financial transactions by eliminating the need for intermediaries and reducing the time it takes to settle transactions. Traditional banking systems often involve multiple parties and lengthy processing times, leading to delays and added costs. With blockchain, transactions can be executed in real-time, 24/7, without the need for manual intervention. This increased efficiency not only saves time but also reduces the risk of errors and discrepancies in financial operations.

**Cost-Effective Solutions**

By cutting out intermediaries and automating processes, blockchain technology has the potential to significantly reduce transaction costs in the financial sector. Traditional financial institutions incur substantial fees for services such as payment processing, currency exchange, and asset transfers. With blockchain, these costs can be minimized, allowing for more cost-effective solutions for both businesses and consumers. The elimination of third-party fees also promotes financial inclusion by making services more accessible to underserved populations.

**Transparency and Accountability**

Blockchain’s transparent nature ensures that every transaction is recorded and visible to all participants in the network. This transparency not only enhances trust but also promotes accountability among users. By providing a clear and auditable record of transactions, blockchain technology reduces the likelihood of fraudulent activities and increases compliance with regulatory standards. This level of transparency is particularly valuable in industries such as supply chain management and auditing, where traceability and accountability are paramount.

**The Future of Finance**

As blockchain continues to evolve and gain mainstream adoption, its impact on modern finance is set to grow exponentially. The technology’s ability to facilitate secure, efficient, and cost-effective transactions has the potential to revolutionize the way we conduct financial operations on a global scale. From digital currencies to smart contracts and decentralized finance (DeFi) platforms, blockchain is reshaping the financial landscape and opening up new possibilities for innovation and growth.

**Embracing the Blockchain Revolution**

In conclusion, blockchain technology has emerged as a game-changer in modern finance, offering a secure, transparent, and efficient alternative to traditional financial systems. By leveraging blockchain’s decentralized architecture and cryptographic principles, businesses and individuals can benefit from enhanced security, reduced costs, and increased trust in their financial transactions. As we look to the future, embracing the blockchain revolution will be key to unlocking the full potential of a digitized and interconnected financial ecosystem.